In this competitive financial sector, a multitude of financial institutions have been offering a variety of services. One of the original goals of each of these companies was to serve customers. One of these rapidly growing service providers is MiFlow, a division of L&T Finance. We have opted to thoroughly review this platform and all of its features in this post. As a result, you will receive a plethora of information on the platform’s capabilities, benefits, MiFlow Login, and several other services. So be sure to read this article all the way through to the end as we examine the subtleties of this platform going ahead.

What is MiFlow

MiFlow’s parent firm, L&T Finance, is a sizable financial services organization with a wealth of knowledge in the microfinance sector. The group aspires to provide financial access to the impoverished. Every year, they assist more than 5 lakh people, therefore they are successful in reaching their goal. So making it more appealing and enhancing customer contact. Its smooth service and catering have made this website a popular choice for clients and people in need of financial assistance. Microfinance statistics are now collected and handled in one place due to the project’s exceptional performance.

Features of the MiFlow

These are only a handful of the platform’s many amazing and fantastic features. By utilizing these features appropriately, you may make the most of this miflow.

- Low Interest Rate: One of the best features of this platform is that it provides users who wish to utilize its services with low interest rates. This has been put in place to guarantee that people may access services without making any reservations.

- Simple Application: Unlike other service providers that need a lot of paper work, ours is an easy application. Here, you experience ease. Your application may be completed quickly and without requiring you to go through any tiresome steps.

- Flexibility: Repayment obligation comes along with financial aid. In place of a one-time pressure, you may now choose a flexible monthly repayment option where you can make the deposit each month.

- Instant: This is one of the best things about this website; the applicant won’t find the processing time to be too long. Within a few days of submission, your application is evaluated and put into process.

How MiFlow Works

Using MiFlow is a straightforward process that involves setting up an account, linking your financial services, and managing transactions seamlessly. Here’s a step-by-step breakdown of how MiFlow works:

- Sign Up – Create an account by providing necessary details such as phone number, email ID, and banking information.

- Verify Identity – Complete identity verification through OTP or authentication mechanisms.

- Link Bank Account or Wallet – Connect your preferred bank account or digital wallet to enable transactions.

- Start Transacting – Perform payments, track expenses, and manage financial operations efficiently.

- Monitor Transactions – Use the dashboard to analyze and track all payments and account activities in real-time.

- Receive Alerts – Get instant notifications on successful transactions, pending payments, and account updates.

Benefits of Using MiFlow

Users of MiFlow enjoy numerous benefits that enhance their financial operations. Some of the key advantages include:

- Time-Saving – Automated tracking and easy transactions save valuable time.

- Better Financial Control – Real-time tracking and reports provide clear insights into finances.

- Secure and Reliable – Advanced security protocols protect users from fraud and unauthorized access.

- Easy Integration – MiFlow can be integrated with various banking and digital payment systems.

- Cost-Effective – Reduces the need for manual financial management, making it an affordable solution.

Eligibility Criteria for MiFlow Merc

You must meet the eligibility requirements in order to take use of the extensive variety of services provided by this platform. As a result, we have included a list of the requirements that you must consider before applying.

- The applicant’s gender must be the primary criteria.

- The applicant for the service cannot be younger than 21 years old.

- The applicant’s monthly salary must exceed Rs. 10,000.

- To receive financial support, a valid business plan is required under Indian rules and regulations.

To select the services offered by the miflow, make sure you have the previously stated documents available.

- Proof of Income: This is one of the most crucial papers for which you will need to present evidence of your income. For this, any type of document might be utilized, such an income tax return or pay stub.

- Identity Proof: The documentation proving your Indian citizenship must be carried with you at all times. This might be any kind of paperwork, such as a voter ID or Aadhar card.

- Age Verification: The candidate must be older than 21 years old, as was previously stated. In addition, the candidate must be under 60, which may be demonstrated using an Aadhar card, voter ID, or other official document.

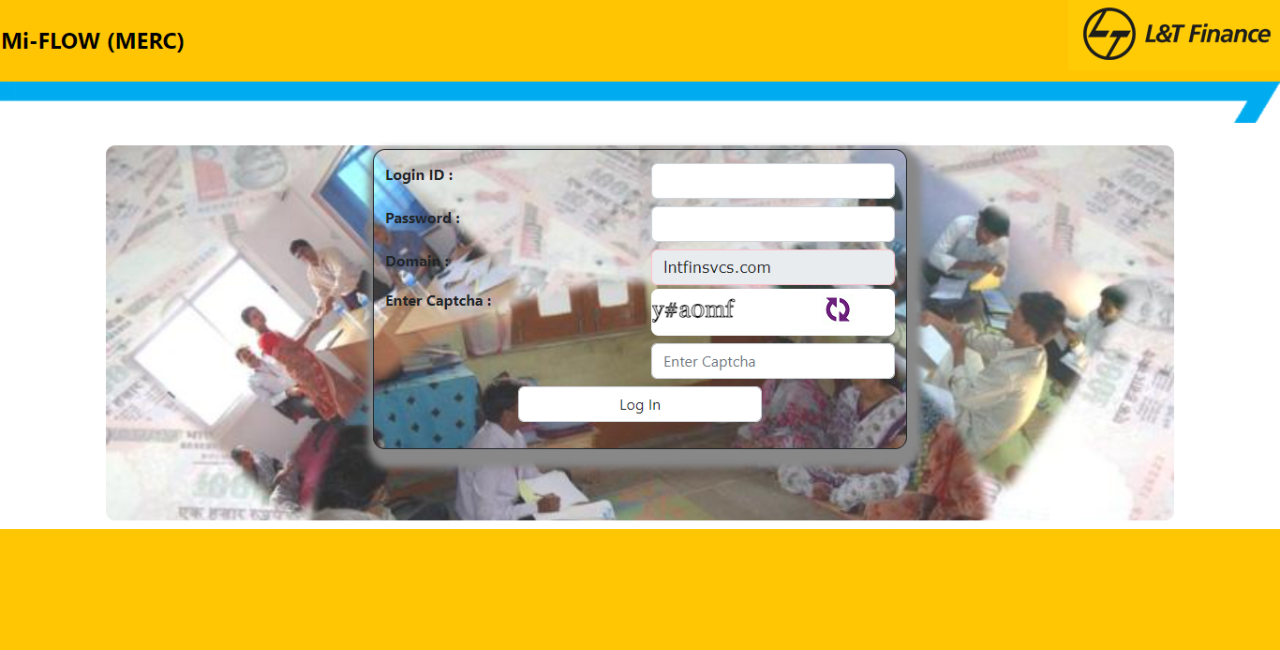

Procedure for Miflow Login

The platform’s login process is really straightforward, making it easily accessible. Here are some instructions that will help you finish the MiFlow Login process quickly and easily.

- The first thing to do is to launch the “Browser” app on your device of choice.

- You must surf the official website with the aid of the browser’s address bar.

- The link that seems official to you must be tapped from the SERPs that show.

- Upon accessing the login dashboard page, a number of input fields will appear.

- You need to type your Login ID, Password, and Domain in the suggested entry fields.

- To pass the human verification test, enter the captcha code that has been supplied.

- To successfully finish the procedure, click the “miflow login” button at the end.

Note: It appears from our most recent study that this platform does not allow online registration. Users may thus need to wait for the same to become available.

Comparison of MiFlow with Other Financial Platforms

To better understand the advantages of MiFlow, let’s compare it with other financial platforms in the market:

| Feature | MiFlow | Platform A | Platform B |

|---|---|---|---|

| Instant Transactions | Yes | Yes | No |

| Automated Payment Tracking | Yes | No | Yes |

| Multi-Platform Access | Yes | No | Yes |

| Security & Encryption | High | Medium | High |

| Bank Integration | Extensive | Limited | Moderate |

| Real-Time Alerts | Yes | No | Yes |

| Flexible Payment Options | Yes | Yes | No |

| User-Friendly Interface | Yes | Moderate | Yes |

As shown in the table, MiFlow offers a superior experience with its security, automation, and seamless financial tracking capabilities, making it a preferred choice for many users.

How Businesses Can Benefit from MiFlow

MiFlow is not just for individual users; businesses can leverage its features to improve financial efficiency. Here’s how businesses can benefit from using MiFlow:

- Automated Invoice Payments – Businesses can automate invoice settlements, reducing manual work.

- Bulk Transactions – Enables organizations to process multiple payments simultaneously.

- Improved Cash Flow Management – Real-time tracking of income and expenses provides better financial planning.

- Enhanced Customer Experience – Secure and instant transactions improve customer satisfaction.

- Reduced Fraud Risks – High-level encryption minimizes the risk of cyber threats.

Future of MiFlow: What to Expect

MiFlow is continuously evolving to offer better services and improved user experiences. Here are some potential developments we can expect:

- AI-Based Financial Insights – Advanced AI tools will provide users with financial analytics and recommendations.

- Blockchain Integration – Implementing blockchain technology for enhanced security and transparency.

- More Payment Integrations – Expanding support for additional banks and digital wallets.

- Improved User Interface – Enhancing the design and usability for a seamless experience.

- Global Expansion – Potential expansion into international markets to cater to a broader audience.

Conclusion

L&T Finance as well as the nearby MiFlow is a daring project undertaken with consideration for contemporary demands and paradigms. It enables users and customers to profit from their service. In addition, you are given greater employment alternatives in which to launch your own company.

READ MORE: Central Board of Secondary Education News : A Deep Dive Into the Latest Updates